Tag: Taxes

17 posts found

Blog WVCAEF January 19, 2023

Inflation Reduction Act Roadshow: Martinsburg, WV – Jan 28th, 1PM

Join the Inflation Reduction Act Roadshow! Next stop is Saturday, Jan. 28th at 1pm at the Martinsburg Library, 101 W King St, Martinsburg, WV 25401. Learn more about the IRA, what funds and rebates are available, and how you can benefit! More

Issues: Energy Efficiency, IRA, Taxes

Inflation Reduction Act Roadshow: Martinsburg, WV – Jan 28th, 1PM

Join the Inflation Reduction Act Roadshow! Next stop is Saturday, Jan. 28th at 1pm at the Martinsburg Library, 101 W King St, Martinsburg, WV 25401. Learn more about the IRA, what funds and rebates are available, and how you can benefit! More

Issues: Energy Efficiency, IRA, Taxes

Blog WVCAEF January 13, 2023

Inflation Reduction Act Roadshow: Martinsburg, WV – Jan 28th, 1PM

Join the Inflation Reduction Act Roadshow! Next stop is Saturday, Jan. 28th at 1pm at the Martinsburg Library, 101 W King St, Martinsburg, WV 25401. Learn more about the IRA, what funds and rebates are available, and how you can benefit! More

Issues: Energy Efficiency, IRA, Taxes

Inflation Reduction Act Roadshow: Martinsburg, WV – Jan 28th, 1PM

Join the Inflation Reduction Act Roadshow! Next stop is Saturday, Jan. 28th at 1pm at the Martinsburg Library, 101 W King St, Martinsburg, WV 25401. Learn more about the IRA, what funds and rebates are available, and how you can benefit! More

Issues: Energy Efficiency, IRA, Taxes

Blog Gary Zuckett December 20, 2022

ATF Release: In Blocking Renewal Of Three Corporate Tax Breaks, Congress Is Poised To Win One For Tax Fairness

In a victory for tax fairness, Congress has rejected in the newly released omnibus spending package the renewal of three major tax breaks urgently sought by big corporations, which were part of the 2017 Trump-GOP tax law. More

Issues: Fair Taxation, Inequality, Taxes

ATF Release: In Blocking Renewal Of Three Corporate Tax Breaks, Congress Is Poised To Win One For Tax Fairness

In a victory for tax fairness, Congress has rejected in the newly released omnibus spending package the renewal of three major tax breaks urgently sought by big corporations, which were part of the 2017 Trump-GOP tax law. More

Issues: Fair Taxation, Inequality, Taxes

Blog WVCAEF August 24, 2022

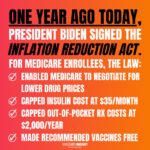

Tele-Town Hall on the Inflation Reduction Act & Tax Fairness

Join West Virginians United for a Tele-Town Hall regarding the Inflation Reduction Act & Tax Fairness on Thursday, August 25th at 6pm! More

Issues: Fair Taxation, Taxes

Tele-Town Hall on the Inflation Reduction Act & Tax Fairness

Join West Virginians United for a Tele-Town Hall regarding the Inflation Reduction Act & Tax Fairness on Thursday, August 25th at 6pm! More

Issues: Fair Taxation, Taxes

Blog Eve Marcum-Atkinson February 9, 2022

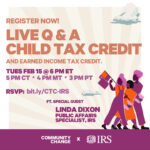

Live Q&A: How to Claim Child Tax Credit and Earned Income Tax Credits on your taxes – Feb 15th @6PM

Community Change be hosting another Live Q&A with Linda Dixon, Public Affairs Specialist at the IRS on Tuesday, February 15th at 6:00 pm ET. Linda will highlight what people need to know for this tax season. More

Issues: Build Back Better, CTC, Taxes

Live Q&A: How to Claim Child Tax Credit and Earned Income Tax Credits on your taxes – Feb 15th @6PM

Community Change be hosting another Live Q&A with Linda Dixon, Public Affairs Specialist at the IRS on Tuesday, February 15th at 6:00 pm ET. Linda will highlight what people need to know for this tax season. More

Issues: Build Back Better, CTC, Taxes

Blog Eve Marcum-Atkinson February 8, 2022

Bad Tax Bill Moving Quickly – Take Action NOW!

Make no mistake, this bill starts a ticking clock that would eventually eliminate the state’s income tax and, with it, nearly half of our state budget. More

Issues: Taxes

Bad Tax Bill Moving Quickly – Take Action NOW!

Make no mistake, this bill starts a ticking clock that would eventually eliminate the state’s income tax and, with it, nearly half of our state budget. More

Issues: Taxes

Blog Eve Marcum-Atkinson January 21, 2022

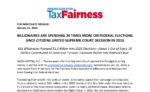

MEDIA ADVISORY: BILLIONAIRES ARE SPENDING 39 TIMES MORE ON FEDERAL ELECTIONS SINCE CITIZENS UNITED SUPREME COURT DECISION IN 2010

661 Billionaires Pumped $1.2 Billion Into 2020 Elections—About 1 Out of Every 10 Dollars Contributed As American Tycoons Translate Riches Into Political Clout More

Issues: Taxes

MEDIA ADVISORY: BILLIONAIRES ARE SPENDING 39 TIMES MORE ON FEDERAL ELECTIONS SINCE CITIZENS UNITED SUPREME COURT DECISION IN 2010

661 Billionaires Pumped $1.2 Billion Into 2020 Elections—About 1 Out of Every 10 Dollars Contributed As American Tycoons Translate Riches Into Political Clout More

Issues: Taxes

Blog Eve Marcum-Atkinson January 5, 2022

AMERICA’S BILLIONAIRES GOT $1 TRILLION RICHER LAST YEAR

Sources: Forbes, "The World's Real-Time Billionaires, Today's Winners and Losers," accessed Dec. 31, 2020 and Dec. 31, 2021 More

Issues: Economy, Taxes

AMERICA’S BILLIONAIRES GOT $1 TRILLION RICHER LAST YEAR

Sources: Forbes, "The World's Real-Time Billionaires, Today's Winners and Losers," accessed Dec. 31, 2020 and Dec. 31, 2021 More

Issues: Economy, Taxes

Blog Gary Zuckett February 12, 2021

WV’s Lone Billionaire, Gov. Jim Justice, Got $12M Richer During Pandemic – How Will Elimination of Income Tax Increase His Wealth?

The wealth of West Virginia’s only billionaire, Gov. Jim Justice, increased by $12 million between mid-March of last year and Jan. 29 of this year, according to a new report by Americans for Tax Fairness (ATF), Health Care for America Now (HCAN) and West Virginia Citizen Action Group. While the governor’s bank account is getting fatter, he is expected to outline a plan to eliminate the Income Tax in his State of the State address today. How much wealth will he gain from this proposal? More

Issues: Coronavirus Relief, COVID-19, Healthcare, Taxes

WV’s Lone Billionaire, Gov. Jim Justice, Got $12M Richer During Pandemic – How Will Elimination of Income Tax Increase His Wealth?

The wealth of West Virginia’s only billionaire, Gov. Jim Justice, increased by $12 million between mid-March of last year and Jan. 29 of this year, according to a new report by Americans for Tax Fairness (ATF), Health Care for America Now (HCAN) and West Virginia Citizen Action Group. While the governor’s bank account is getting fatter, he is expected to outline a plan to eliminate the Income Tax in his State of the State address today. How much wealth will he gain from this proposal? More

Issues: Coronavirus Relief, COVID-19, Healthcare, Taxes

Blog WVCAEF February 3, 2021

Broad Coalition of Organizations Calls on State Leaders to Protect Revenues, Public Services in Upcoming Legislative Session

With West Virginia still feeling the impacts of the COVID-19 pandemic recession, the state’s leaders face difficult decisions in the upcoming legislative session. Increasing numbers of West Virginians are struggling to feed their families, remain in their homes, keep their businesses afloat, and protect their jobs, all while fighting to stay healthy. More

Issues: COVID-19, Healthcare, Taxes

Broad Coalition of Organizations Calls on State Leaders to Protect Revenues, Public Services in Upcoming Legislative Session

With West Virginia still feeling the impacts of the COVID-19 pandemic recession, the state’s leaders face difficult decisions in the upcoming legislative session. Increasing numbers of West Virginians are struggling to feed their families, remain in their homes, keep their businesses afloat, and protect their jobs, all while fighting to stay healthy. More

Issues: COVID-19, Healthcare, Taxes

Blog WVCAEF April 17, 2018

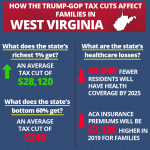

New Tax Law Benefits Health Care Industry, Endangers Vital Services

A new West Virginia report by Americans for Tax Fairness and Health Care for America Now detailing the affects of the new tax law on families in West Virginia and compares that with the tax benefits that health insurance companies and prescription drug manufacturers receive under the same law. Read the full report here. More

Issues: Healthcare, Taxes

New Tax Law Benefits Health Care Industry, Endangers Vital Services

A new West Virginia report by Americans for Tax Fairness and Health Care for America Now detailing the affects of the new tax law on families in West Virginia and compares that with the tax benefits that health insurance companies and prescription drug manufacturers receive under the same law. Read the full report here. More

Issues: Healthcare, Taxes

Blog WVCAEF April 18, 2017

Tax Cuts for the Rich, Health Care Cuts for Everyone Else

Today, WV Citizen Action Group (our sister organization) joined two national groups, Americans for Tax Fairness and Health Care for America Now (HCAN), to release a joint report entitled, Republican Health Care Repeal Plan: Tax Cuts for the Rich, Health Care Cuts for Everyone Else. The report details how the Republican plan to repeal the ACA would give billions in tax breaks to wealthy households, insurance companies and drug manufacturers, paid for by cutting the health care of low- and moderate-income families. More

Issues: Healthcare, Taxes

Tax Cuts for the Rich, Health Care Cuts for Everyone Else

Today, WV Citizen Action Group (our sister organization) joined two national groups, Americans for Tax Fairness and Health Care for America Now (HCAN), to release a joint report entitled, Republican Health Care Repeal Plan: Tax Cuts for the Rich, Health Care Cuts for Everyone Else. The report details how the Republican plan to repeal the ACA would give billions in tax breaks to wealthy households, insurance companies and drug manufacturers, paid for by cutting the health care of low- and moderate-income families. More

Issues: Healthcare, Taxes

Blog WVCAEF February 20, 2010

Report: Small Businesses Reject Role of Money in Politics; View Citizens United Decision as Bad for Business

Read more here More

Issues: Taxes

Report: Small Businesses Reject Role of Money in Politics; View Citizens United Decision as Bad for Business

Read more here More

Issues: Taxes

Blog WVCAEF April 15, 2009

Tax Shell Game: The Taxpayer Cost of Offshore Corporate Tax Havens

Issues: Taxes

Tax Shell Game: The Taxpayer Cost of Offshore Corporate Tax Havens

Issues: Taxes

Blog WVCAEF August 12, 2006

Rick Wilson: Fair Taxes for West Virginia: Challenges and Opportunities

Issues: Taxes

Rick Wilson: Fair Taxes for West Virginia: Challenges and Opportunities

Issues: Taxes

Blog WVCAEF August 11, 2006

A Guide for Answering the WV Tax Modernization Questionnaire

Issues: Taxes

A Guide for Answering the WV Tax Modernization Questionnaire

Issues: Taxes