- Like

- Digg

- Del

- Tumblr

- VKontakte

- Buffer

- Love This

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- Yummly

- SMS

- Viber

- Telegram

- Subscribe

- Skype

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

The vote on the House floor could happen as soon as Thursday morning, so we need to get moving as quickly as possible!

TAKE ACTION on HB 4007 – https://actionnetwork.org/letters/wv-legislators-no-more-tax-cuts-for-the-1-invest-in-us

Yesterday, 2/7/2022, the House Finance committee advanced HB 4007 out of their committee with no discussion, no questions asked, and no fiscal note.

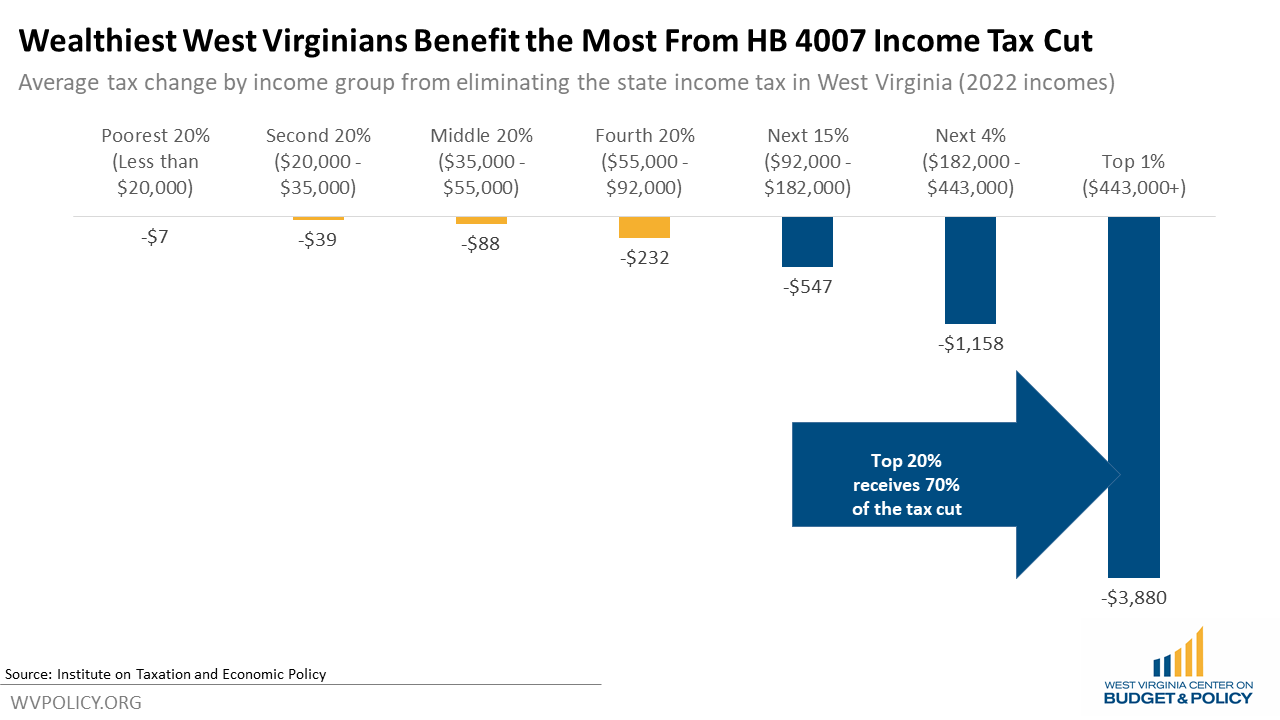

The bill would cut the personal income tax by 10 percent across the board, with the top 20% of income earning households getting a whopping 70% of the tax cut. It would also set up the eventual elimination of the income tax by creating a fund into which 50% of future surpluses would be deposited (funds that currently go into the rainy day fund) in order to eventually eliminate the income tax altogether. Make no mistake, this bill starts a ticking clock that would eventually eliminate the state’s income tax and, with it, nearly half of our state budget.

The fiscal note, which is now available, makes clear that HB 4007’s income tax reduction plan shares the same flaw as versions that failed to pass last year: relying on a one-time source of revenue – in this case a one-year budget surplus – to fund a permanent, ongoing tax cut. That means next year and every year after, lawmakers will likely either need to raise other taxes, cut services, or some combination of both to pay for the ongoing tax cut. This puts at risk all of the programs we care about: K-12 education, health care, programs for kids, and more. While most families will see very little tax cut, they will be deeply impacted by cuts to programs. And future cuts aren’t all we need to worry about. We know that the programs we care about are currently underfunded. In the DHHR budget hearing, they shared that they have 1,400 vacant positions and a $145 million shortfall NEXT YEAR that will need to be urgently addressed. To use a surplus to cut taxes for the wealthiest households in our state instead of addressing these urgent needs is short-sighted, immoral, and bad for our state’s economy.

Here’s what you can do right now to help:

- Send an email to your legislators right now by using this link: https://actionnetwork.org/letters/wv-legislators-no-more-tax-cuts-for-the-1-invest-in-us

- Call any House members you have a relationship with- including Democrats- we need to make clear to members on both sides of the aisle that this is a dangerous bill that is not politically advantageous (and we shouldn’t play politics with our budget anyway!)

- Share this post on social media: https://wvpolicy.org/house-personal-income-tax-cut-plan-largely-benefits-wealthy-not-fiscally-sustainable/